Press release, 'KFTC imposes sanctions against Qualcomm's abuse of SEPs of mobile communications' (Dec 28, 2016)

KFTC imposes sanctions against Qualcomm's abuse of SEPs of mobile communications

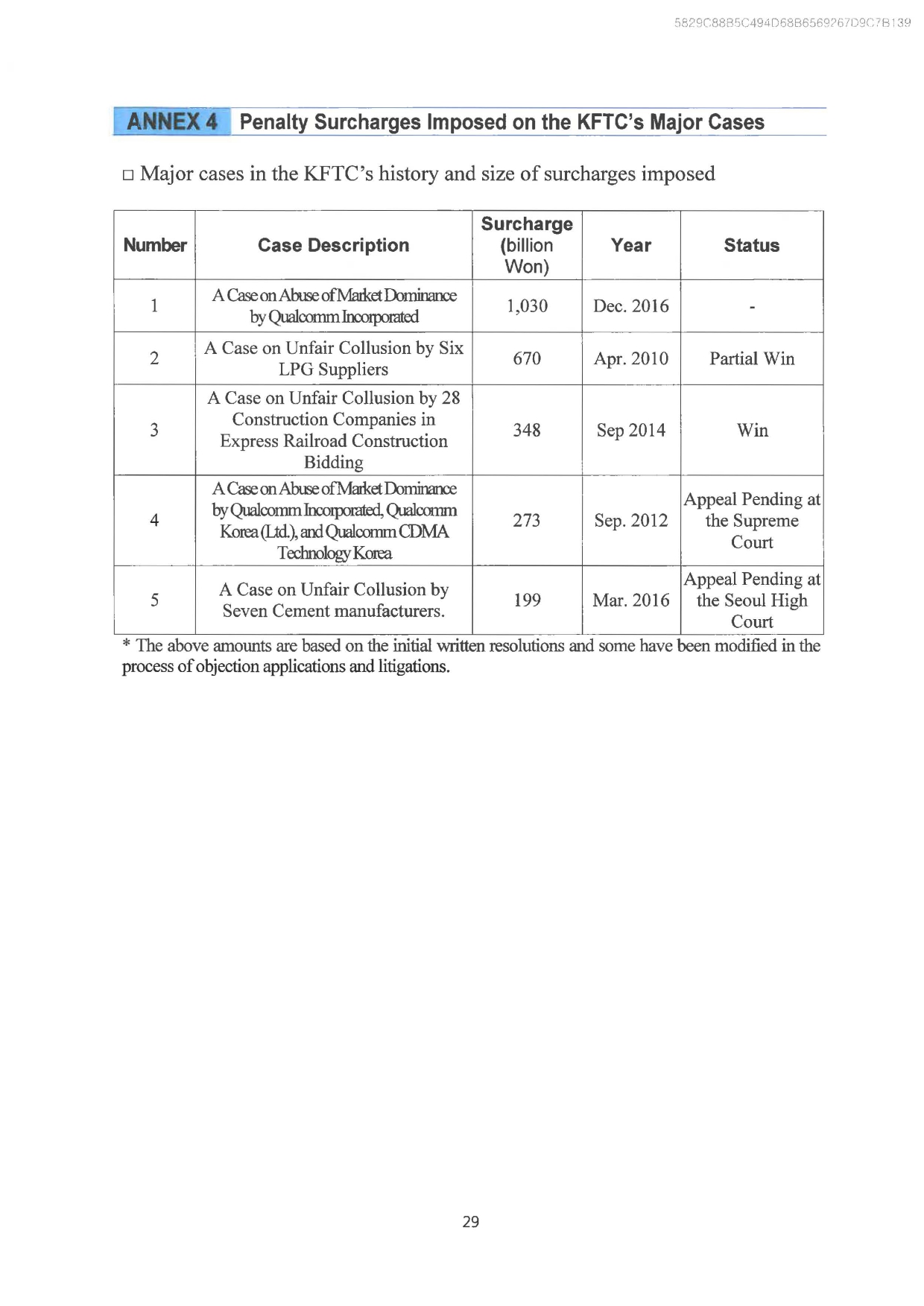

- imposes 1.03 trillion won, the highest penalty surcharge ever handed to an

individual company by the KFTC and remedies on unfair business model -

<Summary>

■ The Korea Fair Trade Commission (headed by Chairman Jeong Jae-chan, hereinafter referred to as the "KFTC") has decided in the plenary session held on Wednesday, Dec.21.2016 to impose remedies along with a penalty surcharge amounts to 1.03 trillion won on Qualcomm Incorporated, QI* and its two affiliated companies** (hereinafter collectively "Qualcomm"), which is a global modem chipset maker and patent-licensing operator for the abuse of market dominance.

* QI is the U.S. headquarters of Qualcomm and operating a patent licensing business

** Qualcomm Technologies Inc. (QTI) and Qualcomm CDMA Technologies AsiaPacific PTE LTD (QCTAP) are doing modem chipset business for mobile communications.

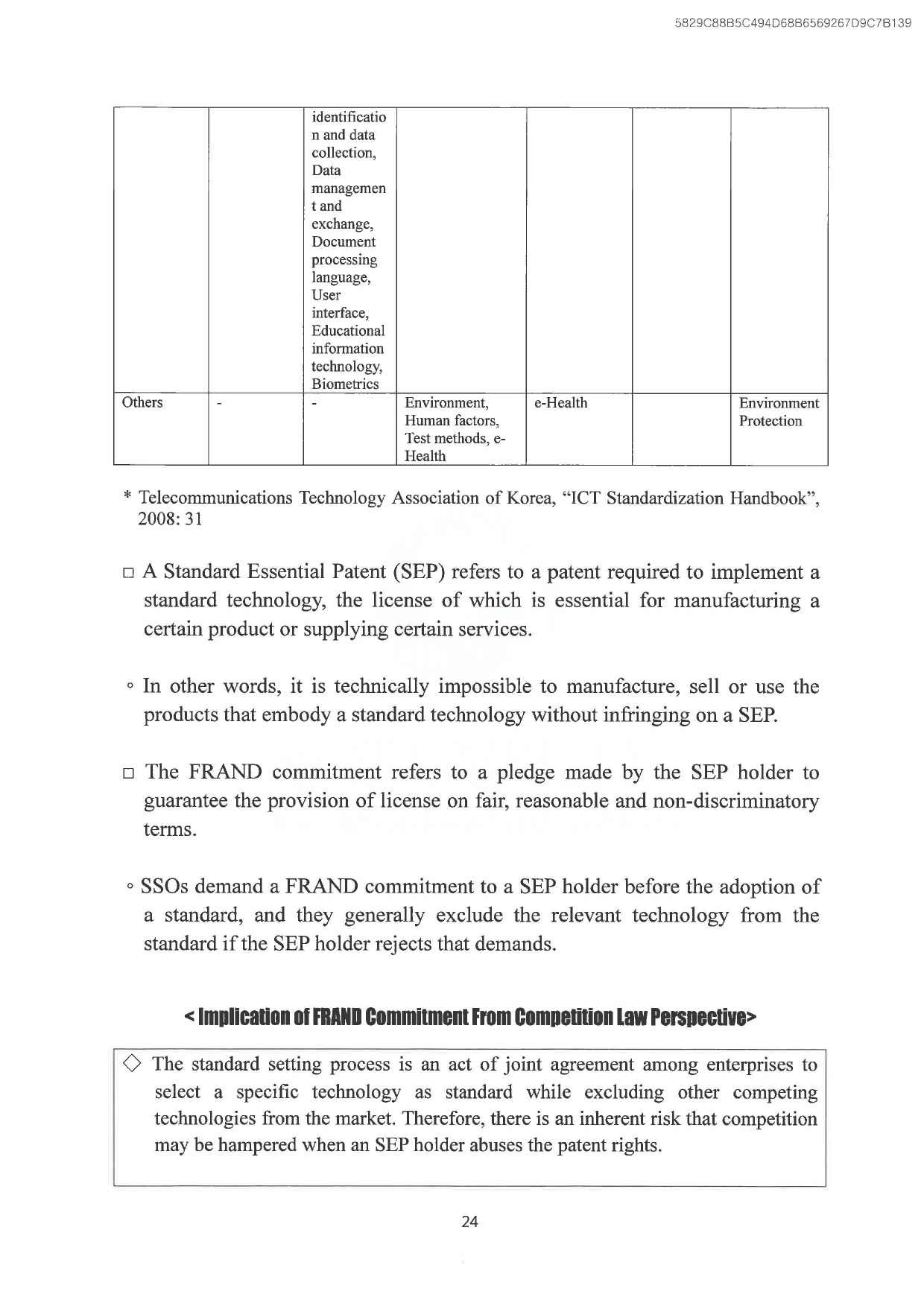

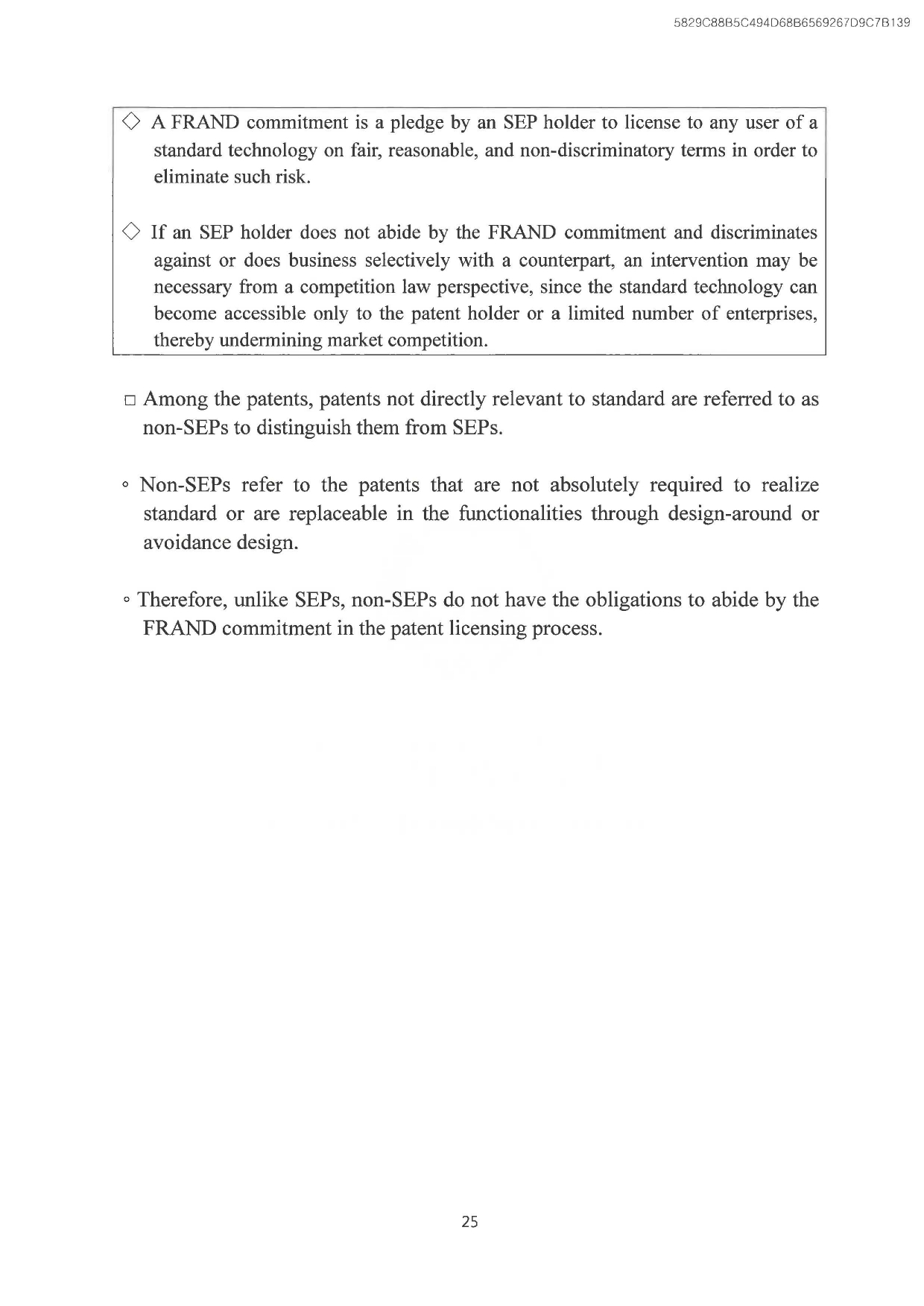

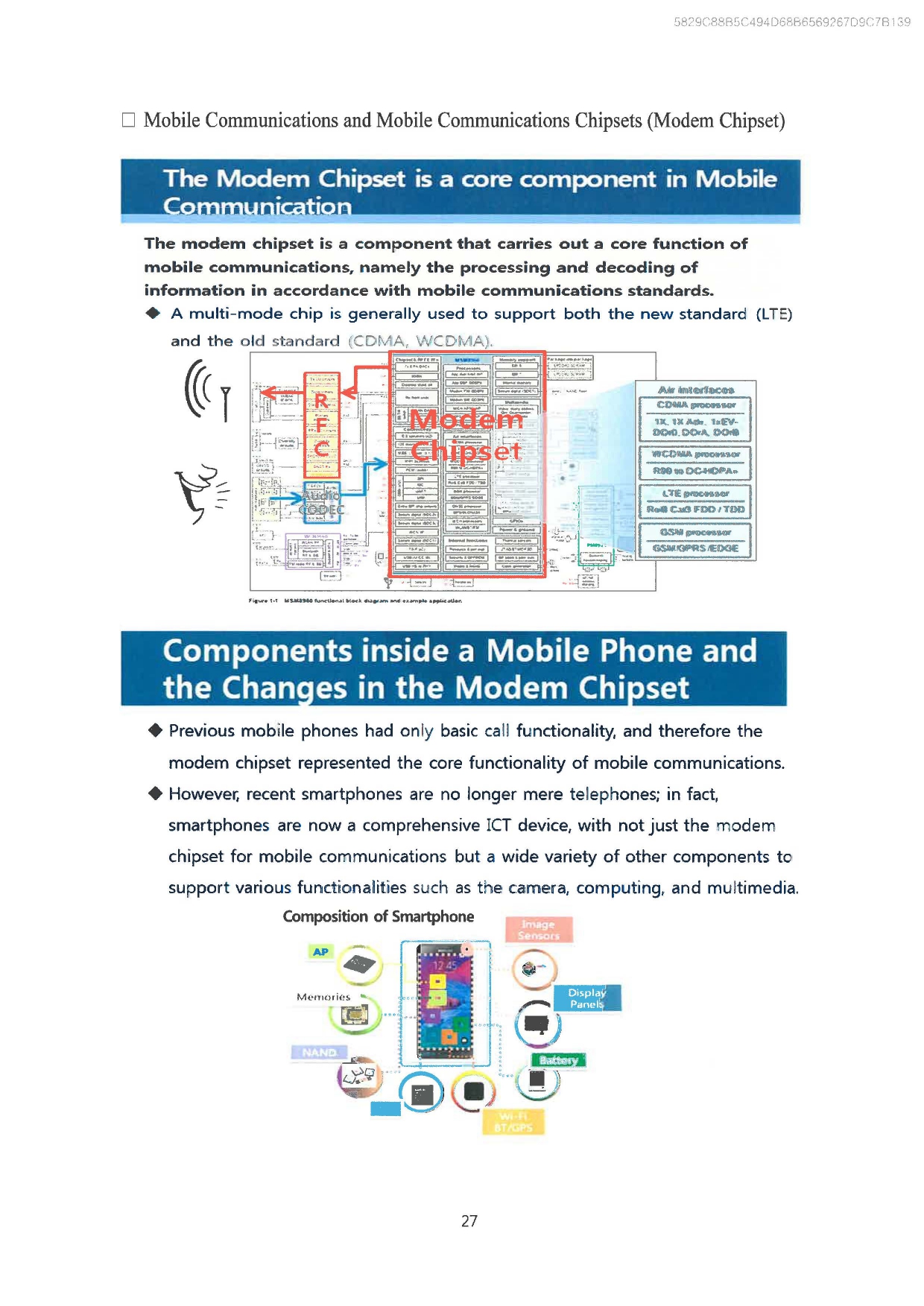

■ Qualcomm is a SEP holder that declared the FRAND commitment* to SSOs such as ITU and ETSI regarding mobile communications standard technology such as CDMA, WCDMA and LTE. Qualcomm is also vertically integrated monopolistic company that manufactures and sells modem chipsets. It has engaged in the following conducts in violation of the FRAND commitment.

* FRAND commitment refers to a promise that SEP holders will license to the patent users in a fair, reasonable and non-discriminatory manner.

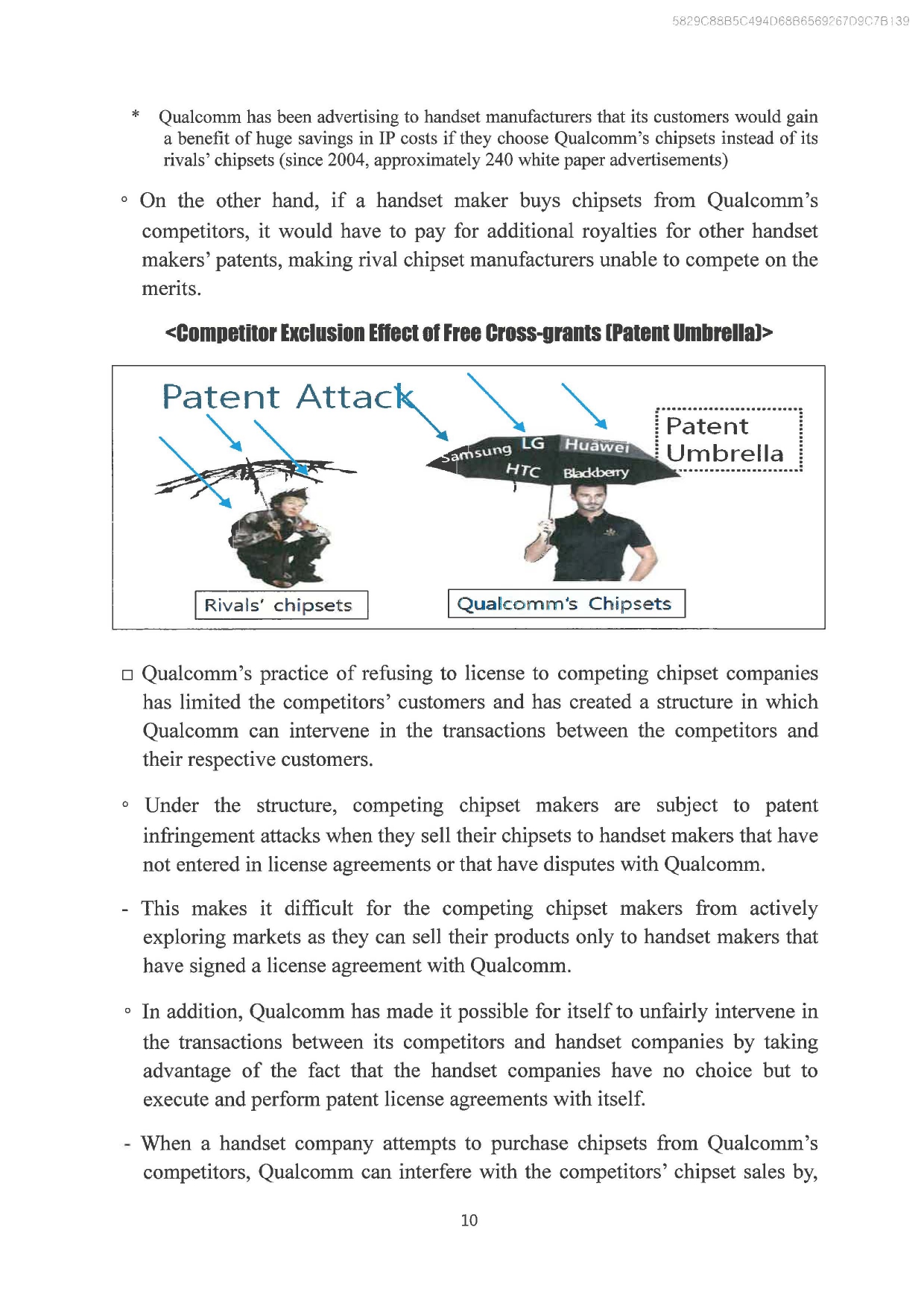

① Notwithstanding requests from rival modem chipset makers, Qualcomm refused or restricted the licensing of mobile communications SEPs (Standard Essential Patents) that are essential in manufacturing and selling the chipsets in market.

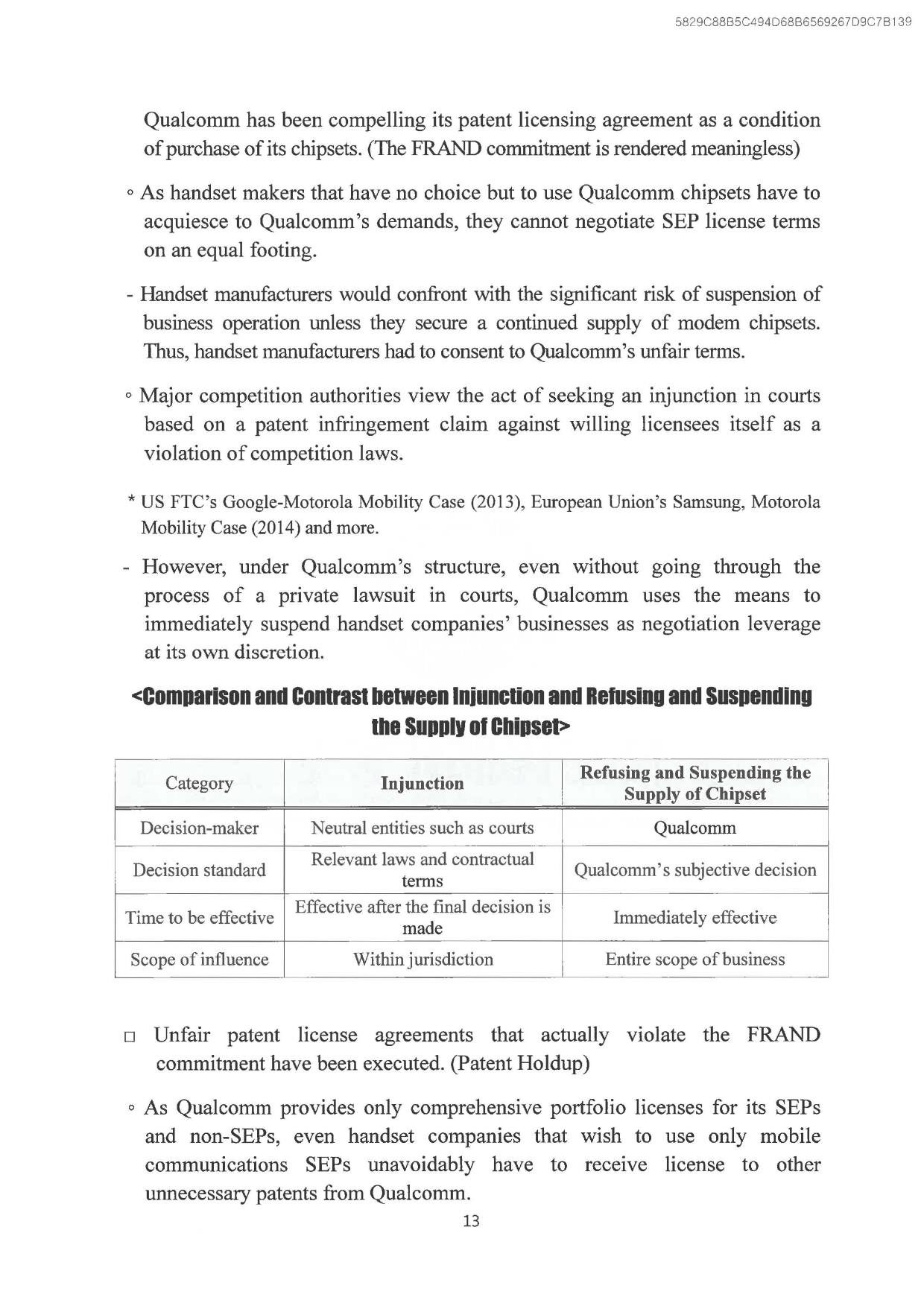

② Qualcomm coerced handset makers to sign unfair license agreements by linking the chipset supply with patent license agreements, using its market position as a leveraging tool in its negotiations and circumventing the FRAND commitment.

③ Qualcomm only offered the comprehensive portfolio license to handset makers and forced unilaterally-decided licensing terms without undergoing a reasonable value assessment process. Also, it coerced handset makers to accept unfair agreements such as making them license their patents for free.

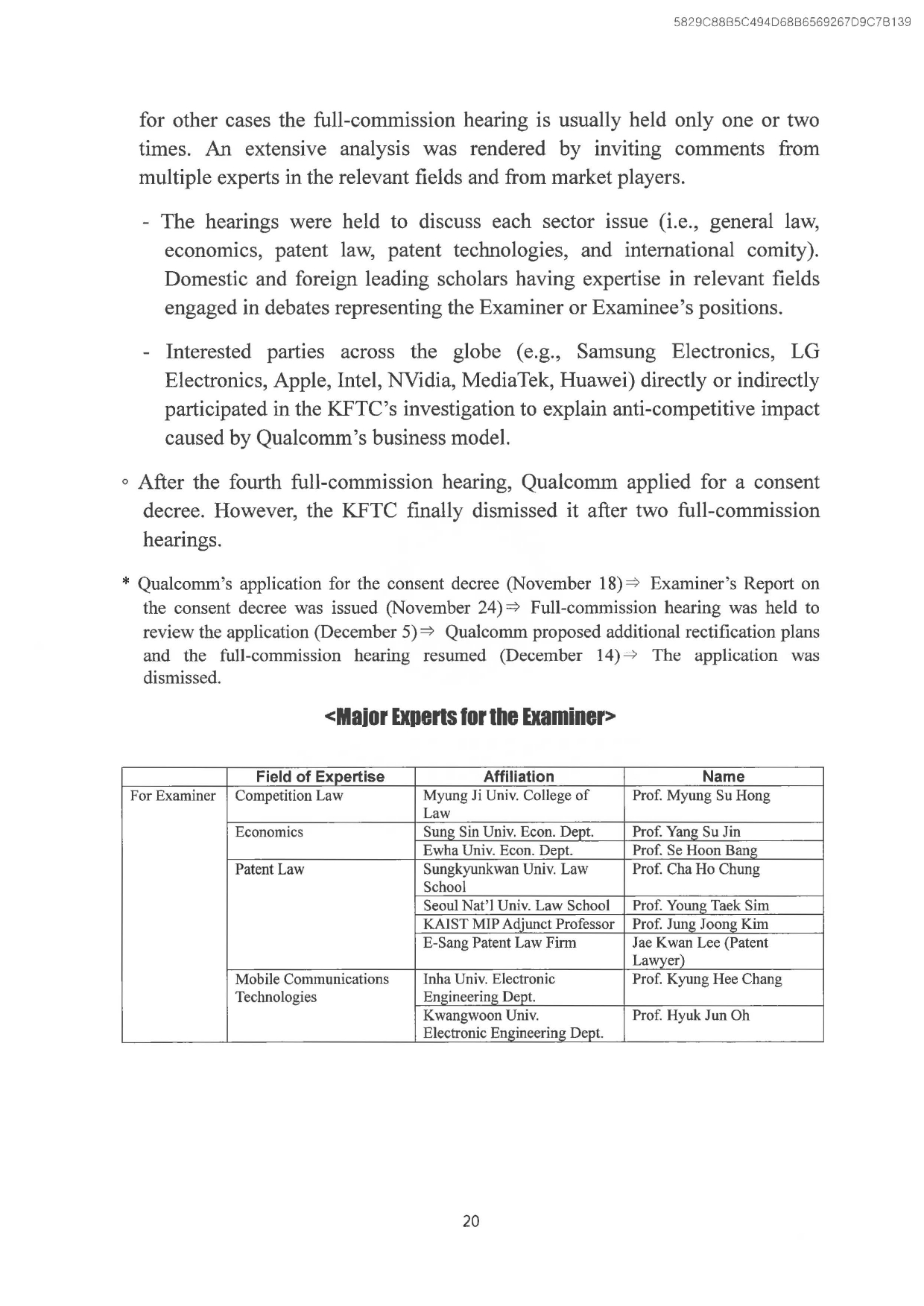

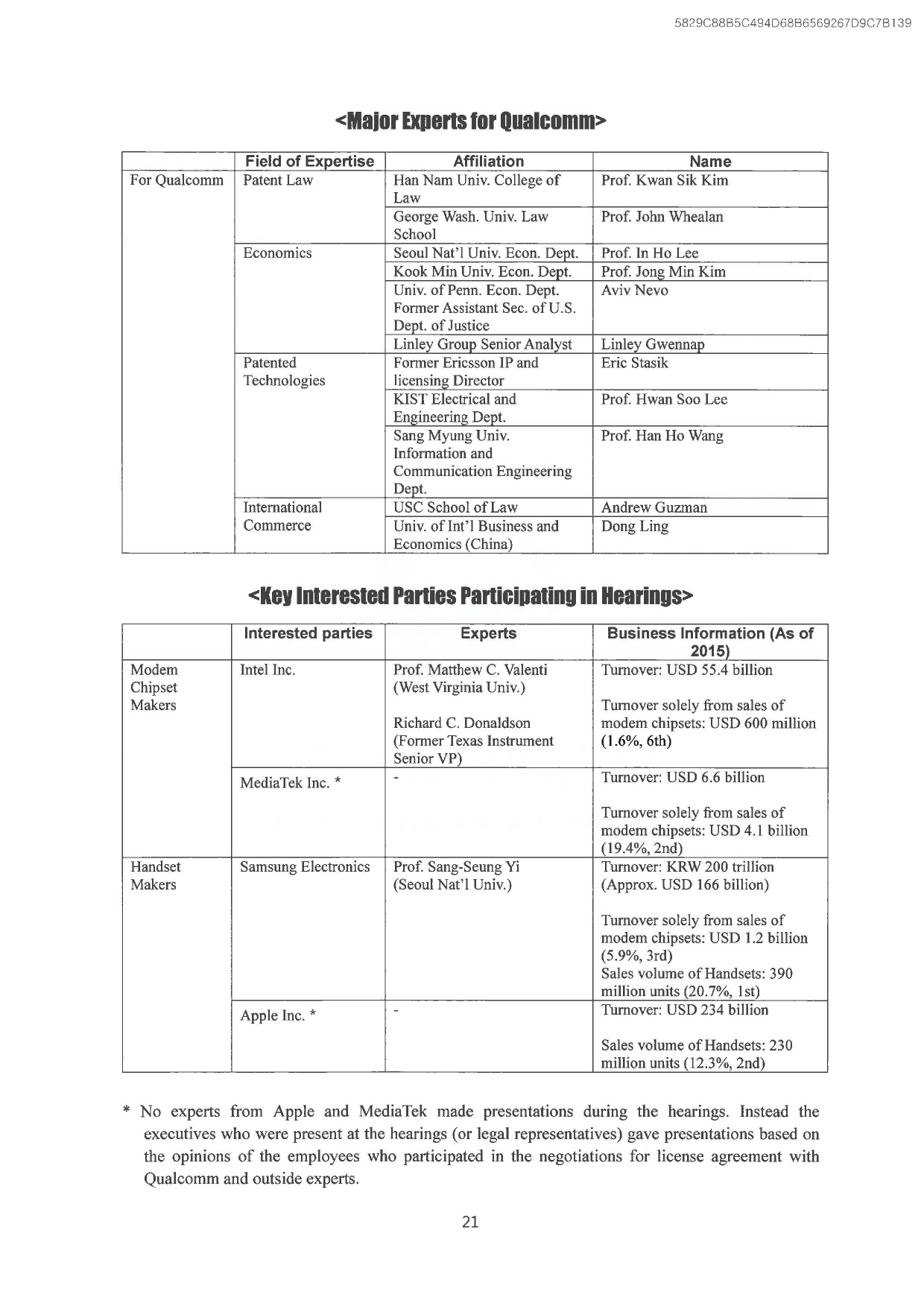

■ After completing the investigation on the illegal conduct described above, the KFTC sent an examination report to Qualcomm on Nov. 13 last year, and held a total of seven hearings including the two regarding the consent decree and conducted an in-depth review of the case since this July.

○ Moreover, the KFTC reviewed the case from various angles by inviting not only Korean companies such as Samsung and LG but also other global ICT companies including Apple (US), Intel (US), Nvidia (US), MediaTek (Taiwan), Huawei (China) and Ericsson (Sweden) to the hearings.

■ This case is meaningful in that the KFTC is the first to impose corrective measures on Qualcomm's unfair business model that has been coercing unilateral licensing terms to mobile phone manufacturers, while refusing to license to competitors in order to strengthen its monopoly power in the patent license market and chipset market.

○ In particular, the measures are designed to tum 'an exclusionary ecosystem that allows Qualcomm to be an exclusive beneficiary' into 'an open ecosystem where any industry player can enjoy the incentives of innovation that it has achieved'. It is expected that this imposing of measures serve as the trigger to restore the fair competition in the mobile communications industry.

Ⅰ. Market Structure and Current status

1. Market Structure

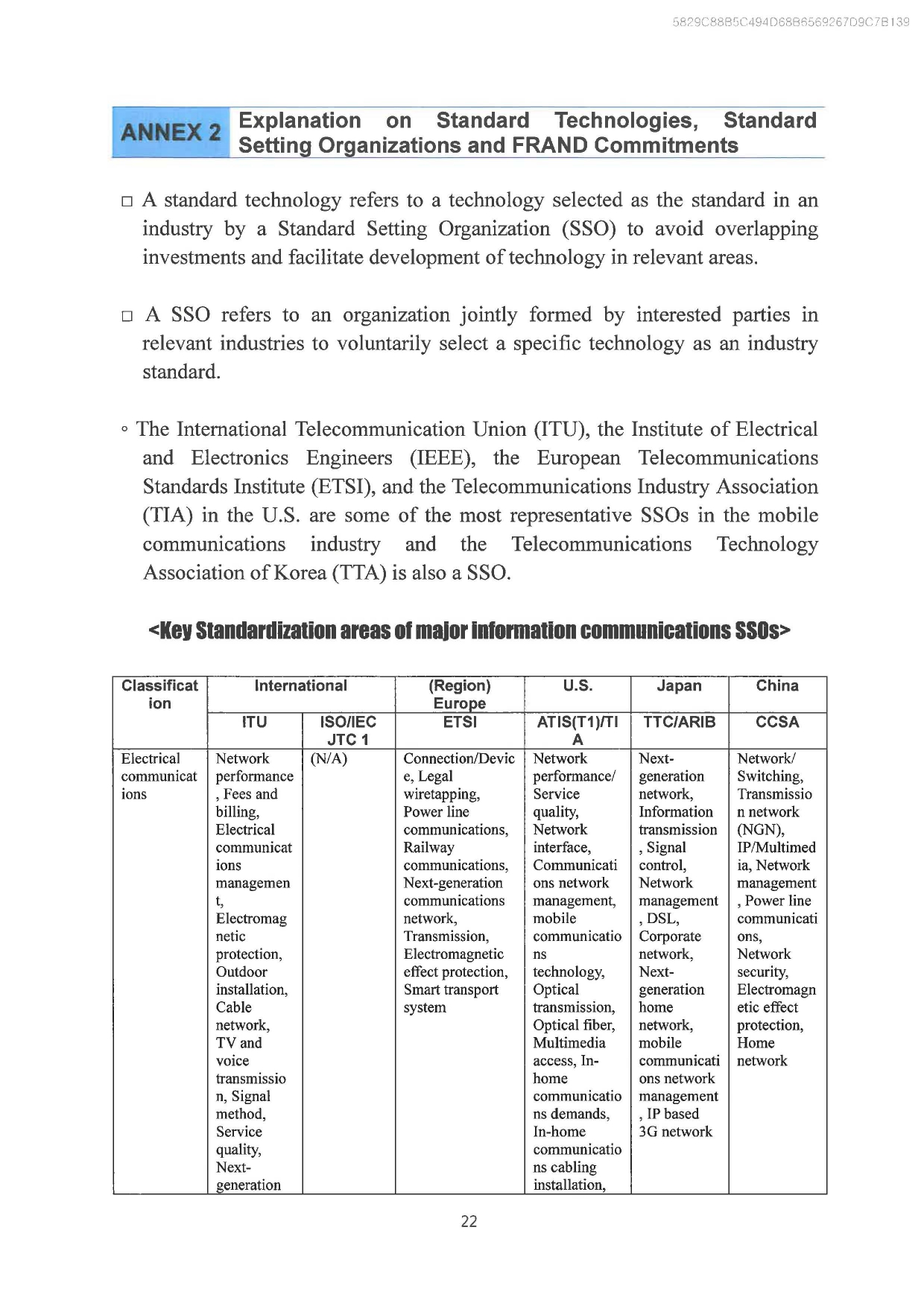

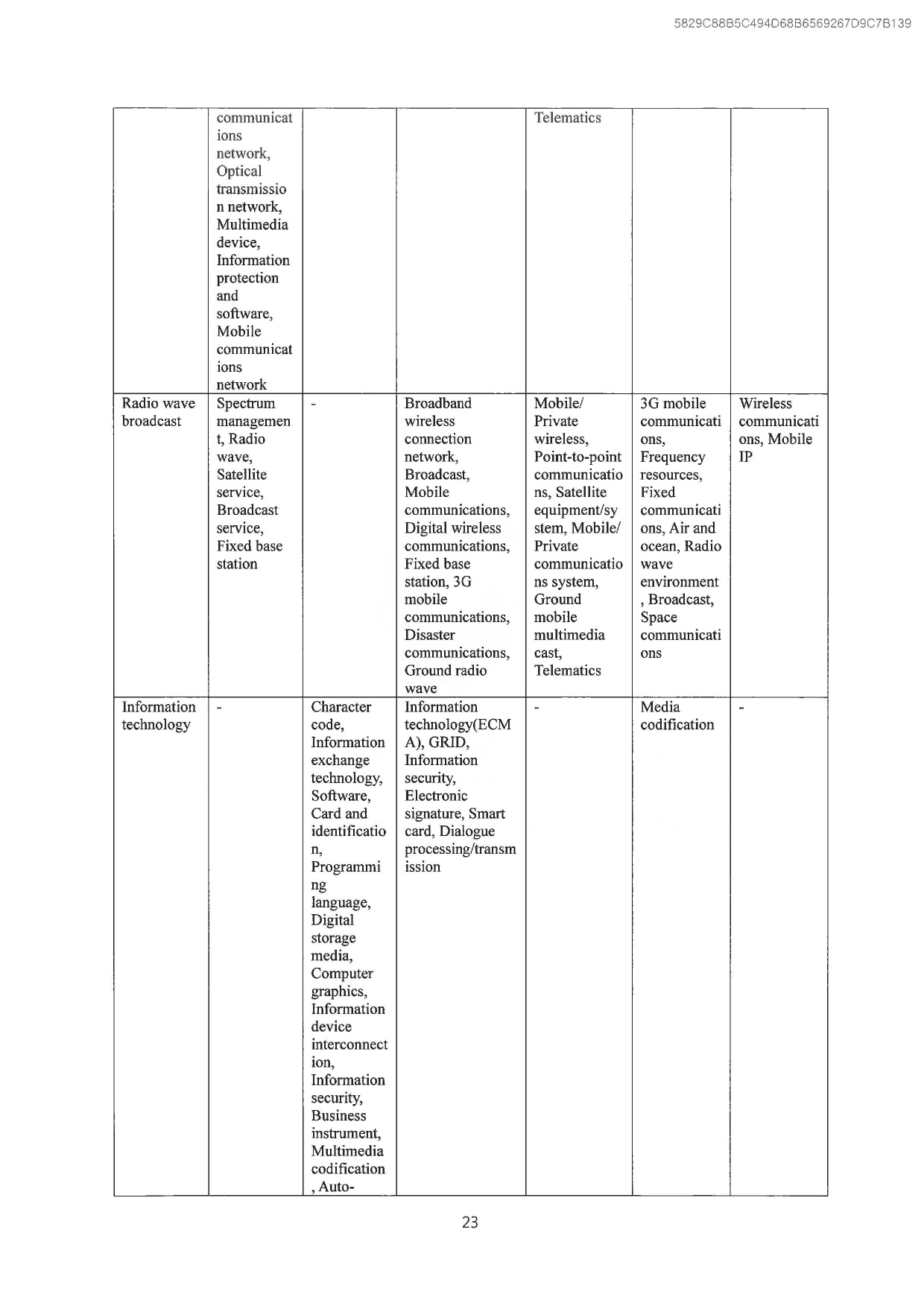

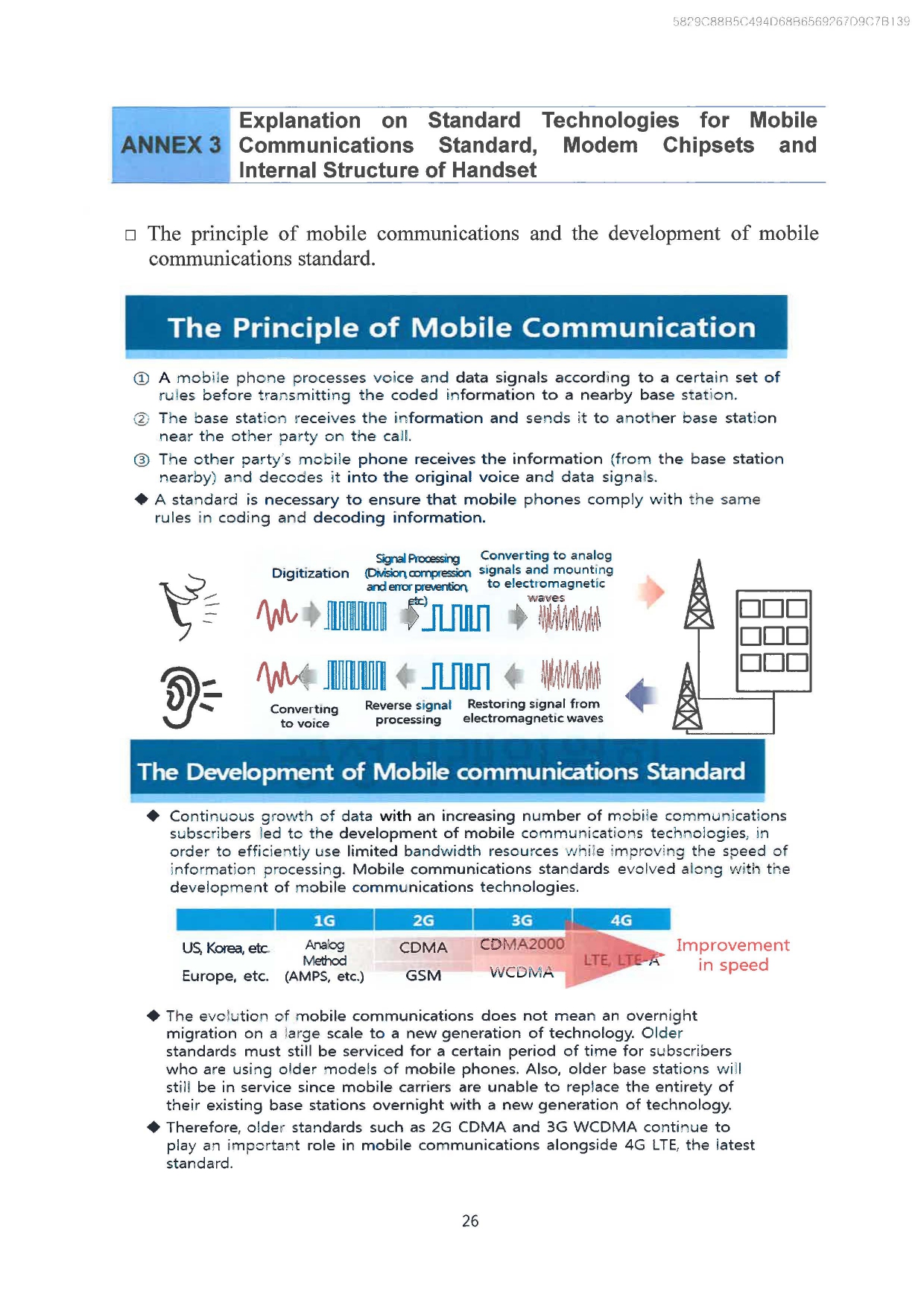

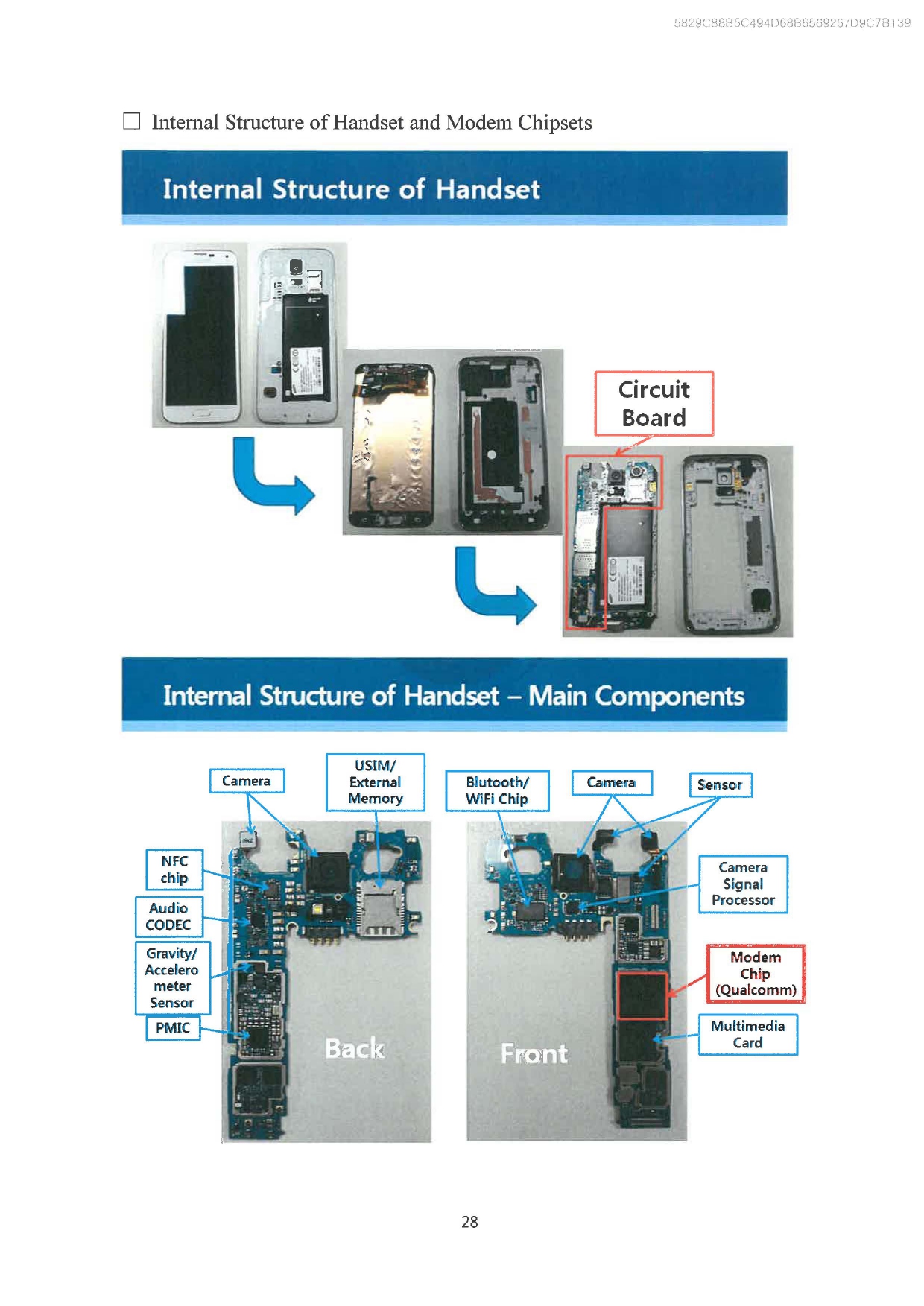

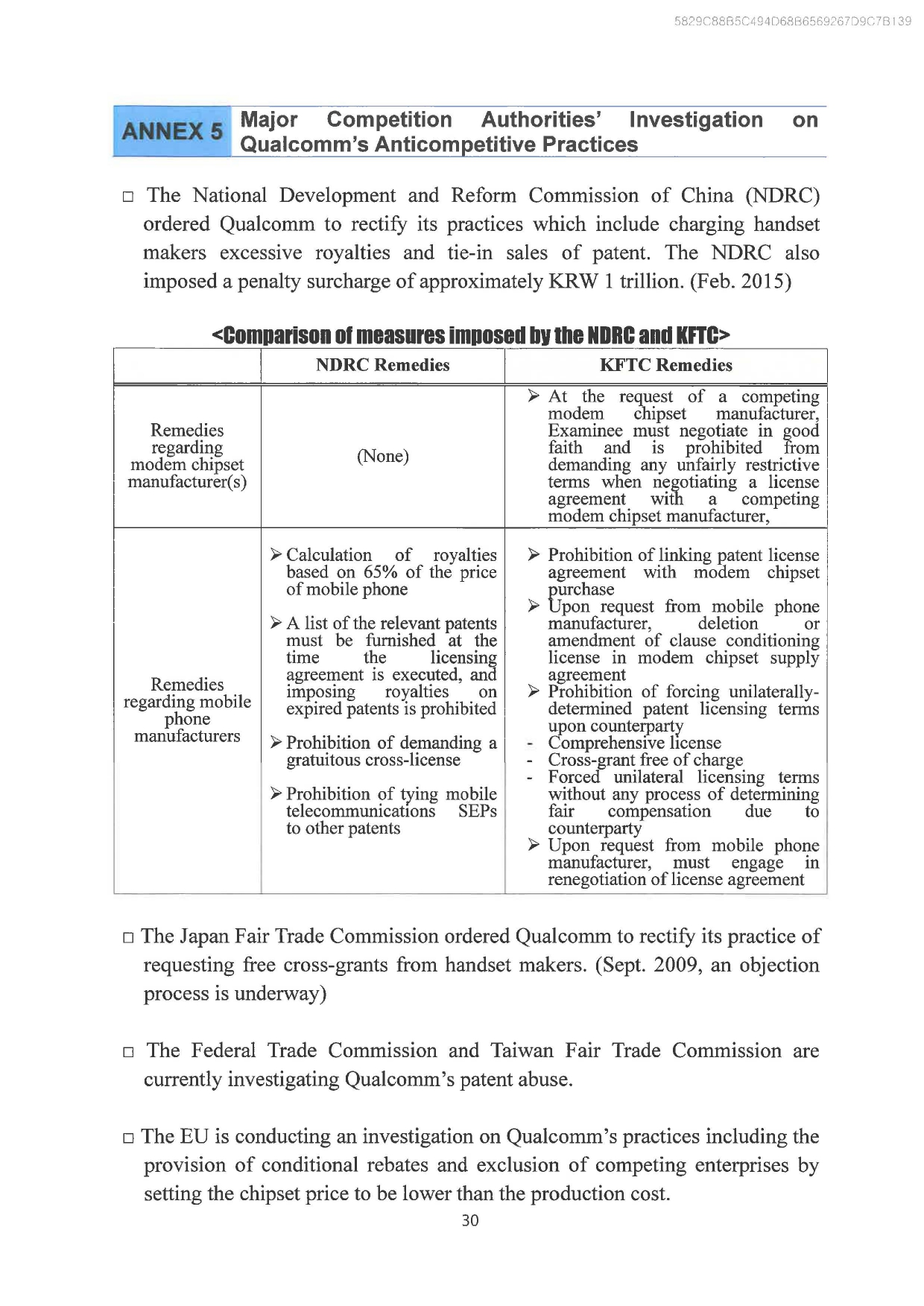

□ The mobile communications industry consists of patent license market, component market such as modem chipset, handset market and mobile communications service market.

○ Qualcomm is a vertically integrated monopolistic enterprise that engages in patent licensing and modem chipset businesses, which are upstream markets in the overall market structure.

<Overview of the Market Structure of the Mobile Communications Industry >

2. Relevant Markets and Market Dominance

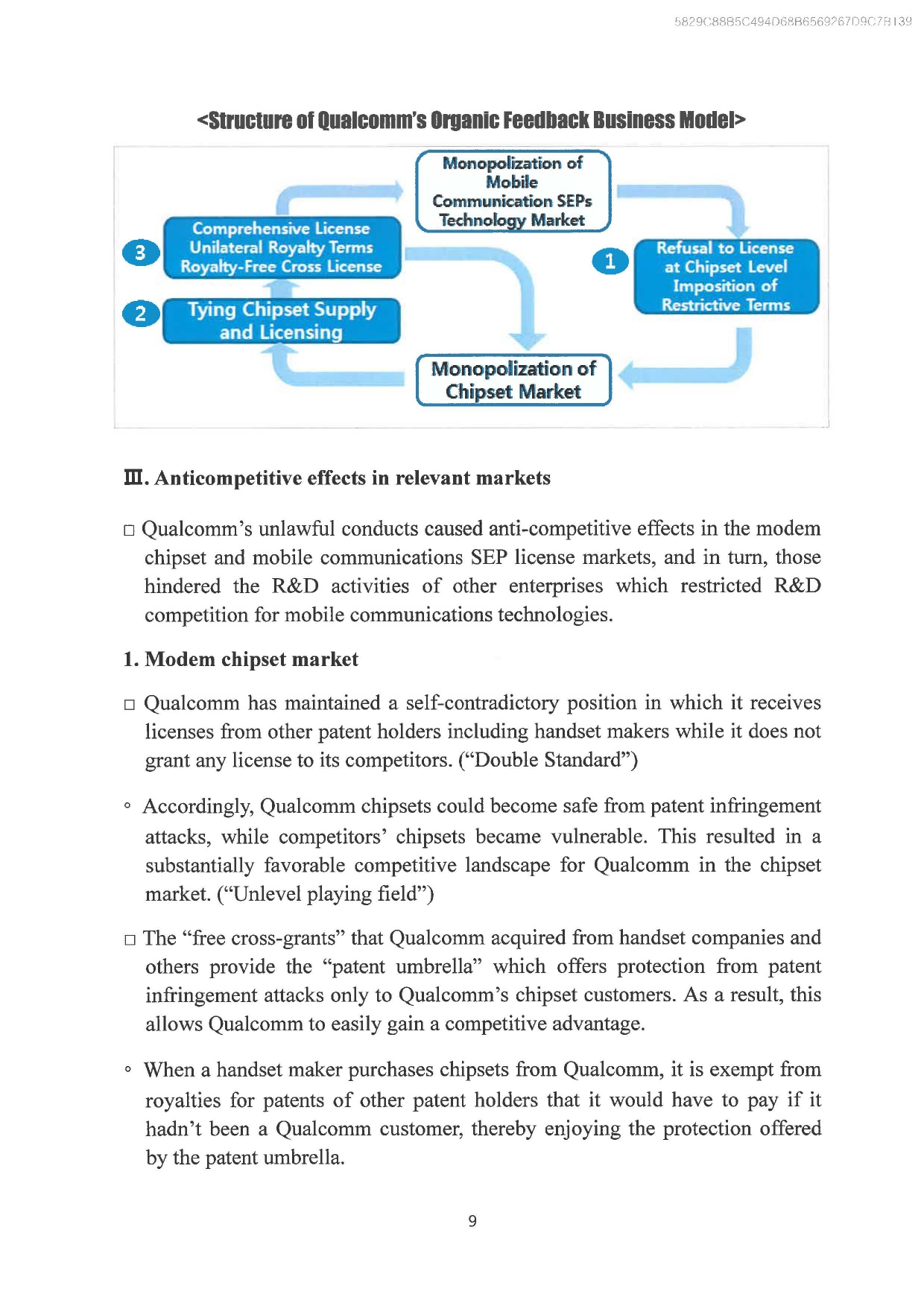

□ (Mobile communications SEP license market) Qualcomm owns the largest number of SEPs over the mobile communications generations of 2G (CDMA), 3G (WCDMA) and 4G (LTE).

○ Since SEP is irreplaceable with other technologies, a SEP holder with even just one SEP will gain a complete monopoly power.

※ Unlike CDMA, most of which had been possessed by Qualcomm, the share of Qualcomm in the WCDMA and LTE dramatically decreased to 27% and 16% respectively.

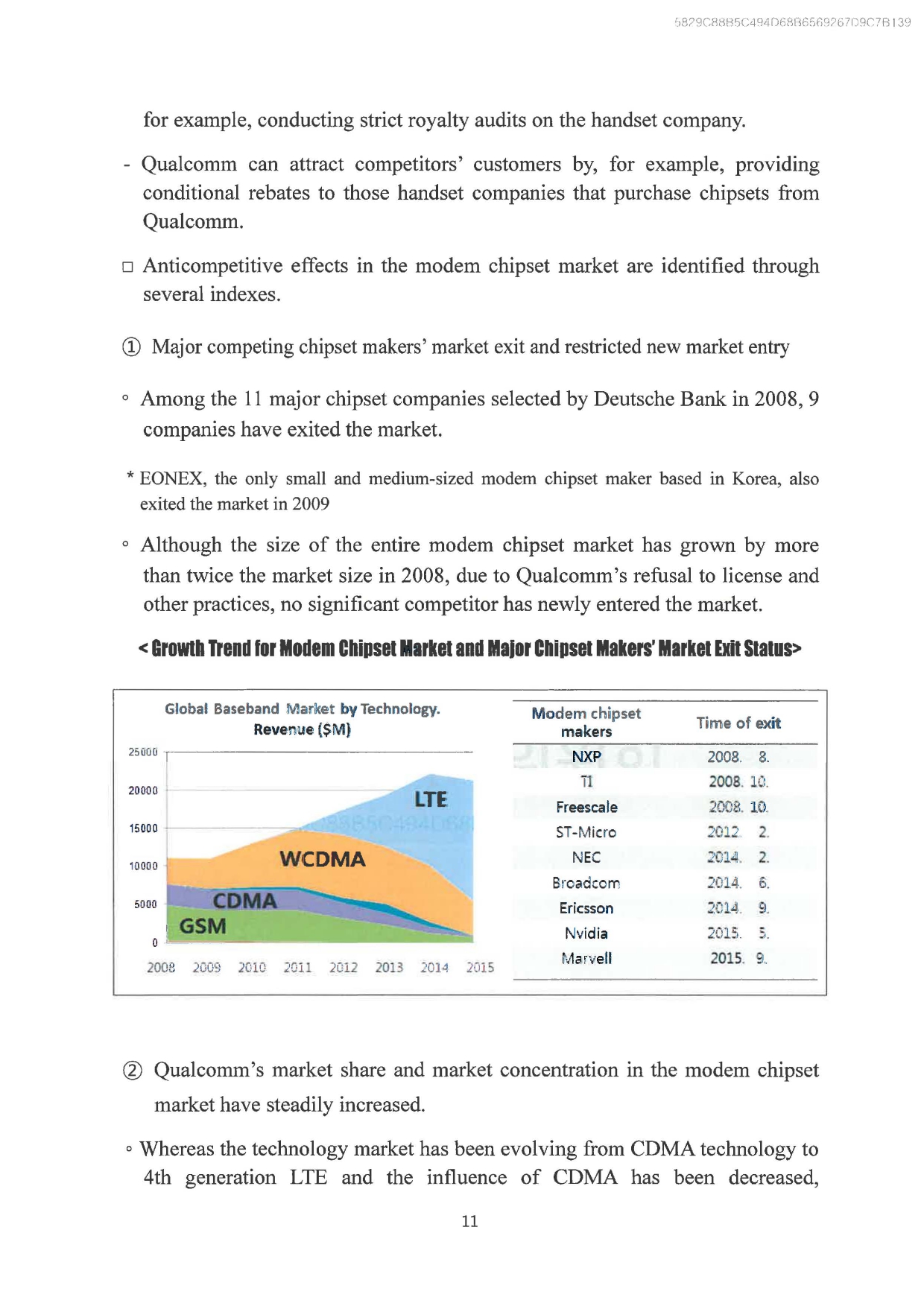

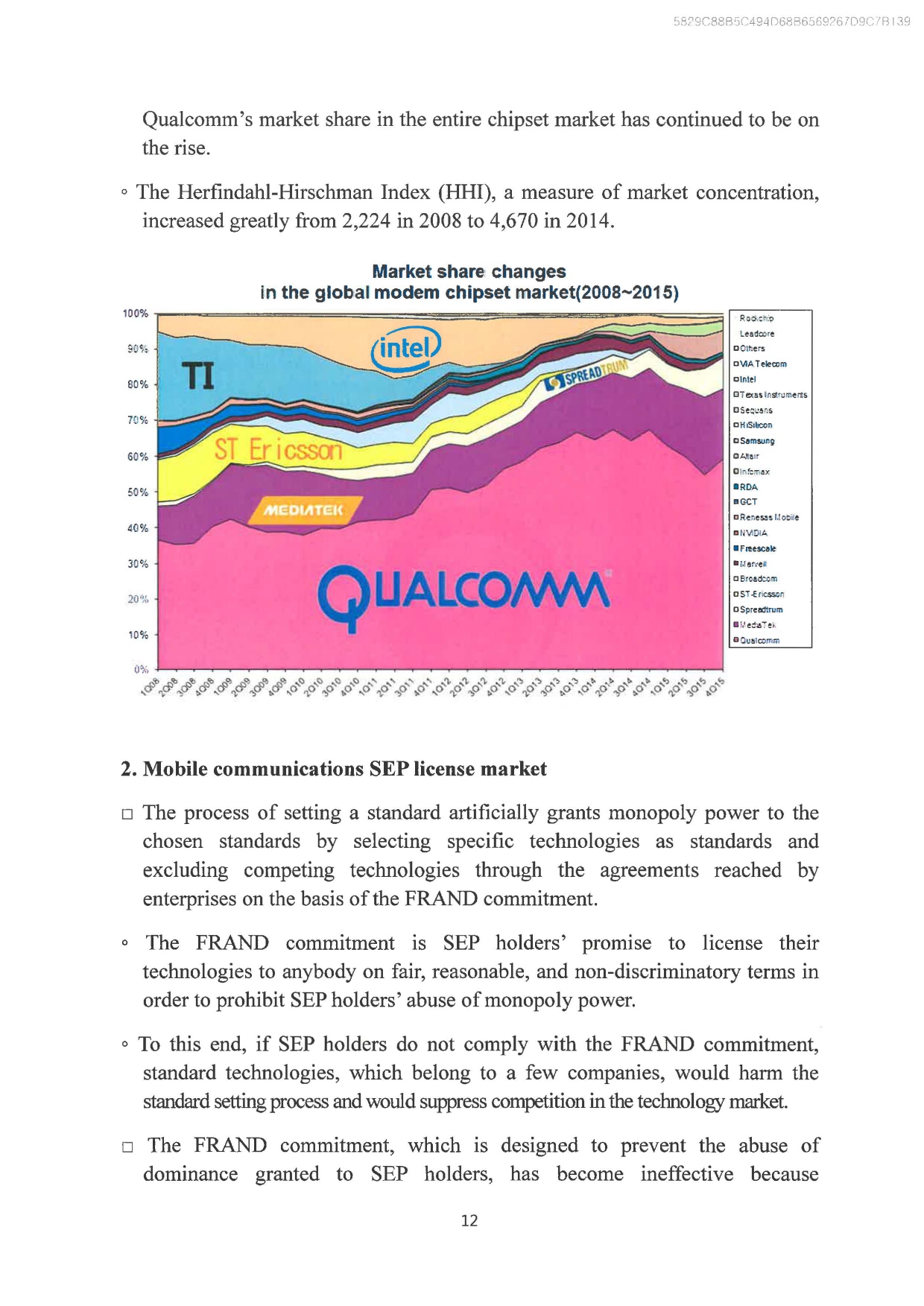

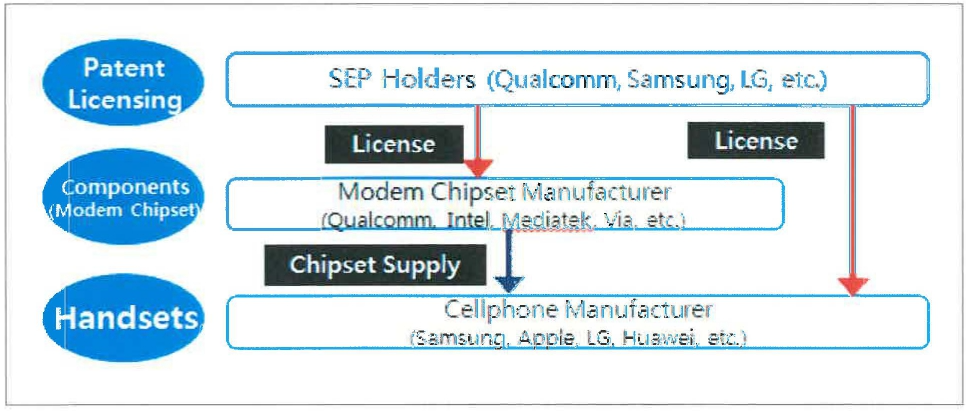

□ (Modem Chipset market) Qualcomm holds its monopolistic position in the CDMA modem chipset market, and also has long maintained its market dominance in the WCDMA and LTE markets.

○ Even today with the spread of LTE technology, Qualcomm still exclusively supplies multimode CDMA-LTE chipsets that are backward compatible with CDMA.

* Backward Compatibility: Evolution of mobile communications does not necessarily mean a simultaneous change in communications standards because there are still users of handsets with old standards, and it takes a considerable time to replace base stations. Therefore, modem chipsets and mobile phones have to support not only new standards but also the old standards.

○ Moreover, Qualcomm holds an unrivaled position for the high-end premium products.

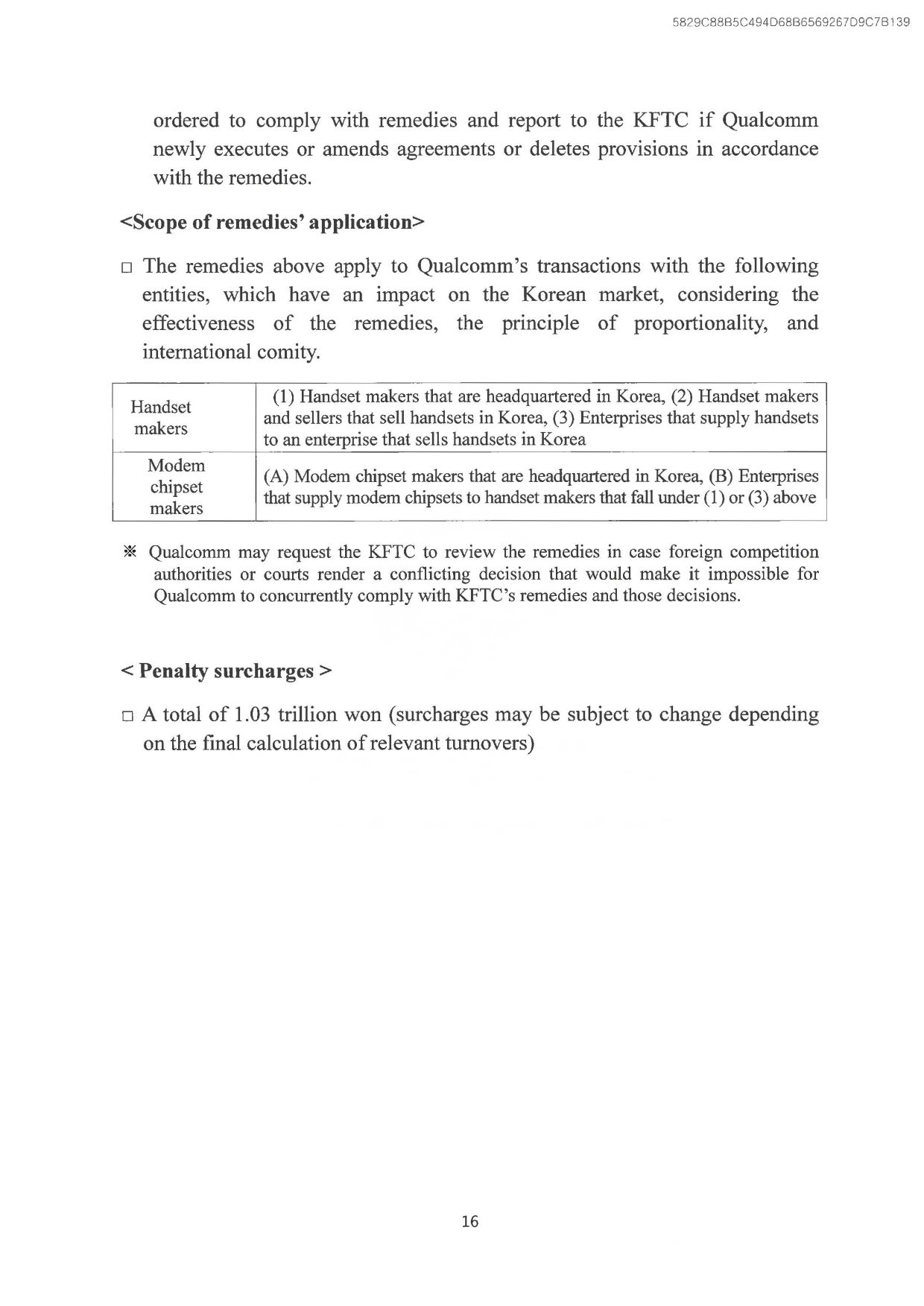

<Qualcomm's Market Share Trend in Modem Chipset Market per standard>

( * Based on revenues)

3. Current Status of Qualcomm's Revenues

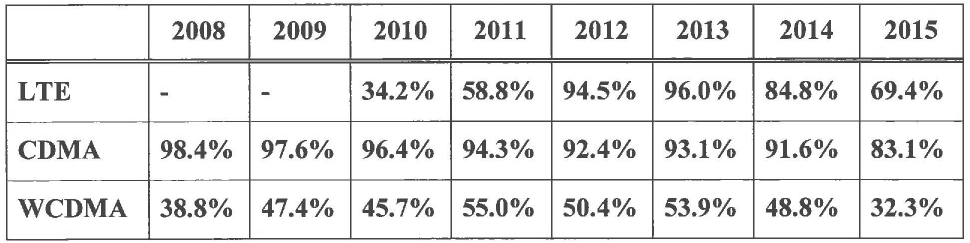

□ Qualcomm's annual global modem chipset turnover and patent royalty revenue amount to 25.1 billion USD. (As of 2015)

< Qualcomm's global revenues IMillion USDJ >

○ The turnover derived from the Korean market slightly differs from year to year, but is approximately 20% of the total global turnover.

* The proportion of the Korean market per year (2013: 20%, 2014: 23%, 2015: 16%)

Ⅱ. Facts of Violation

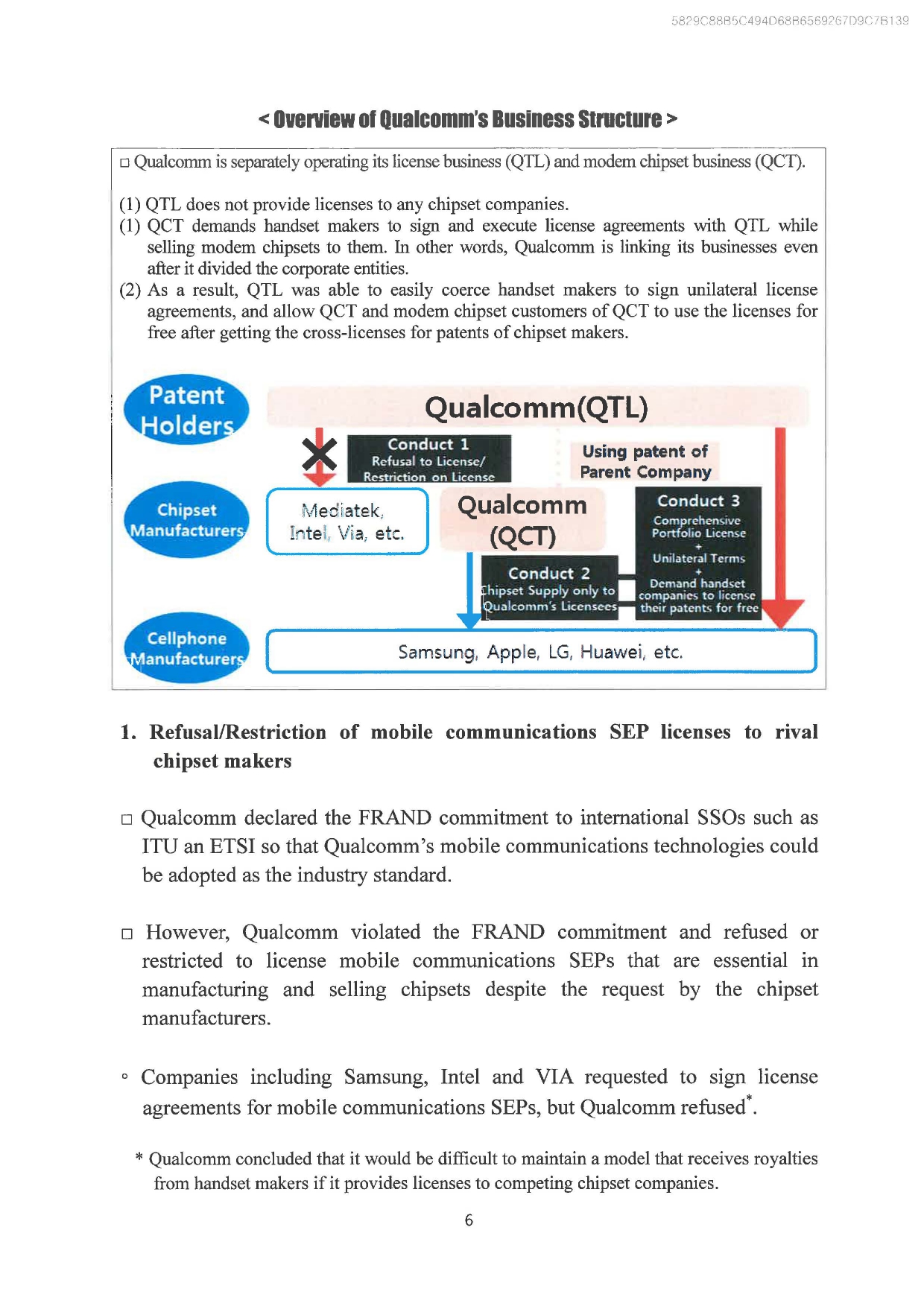

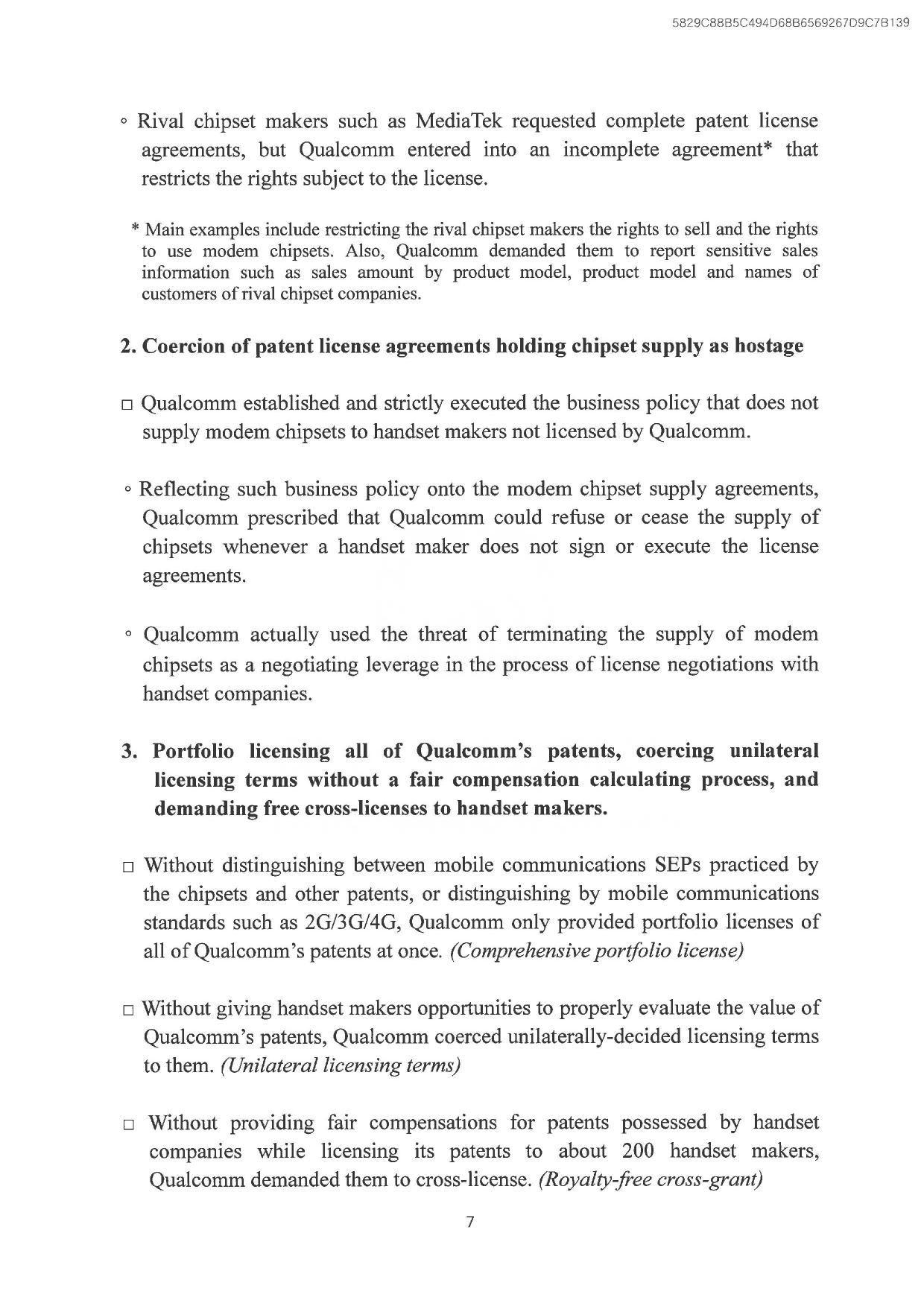

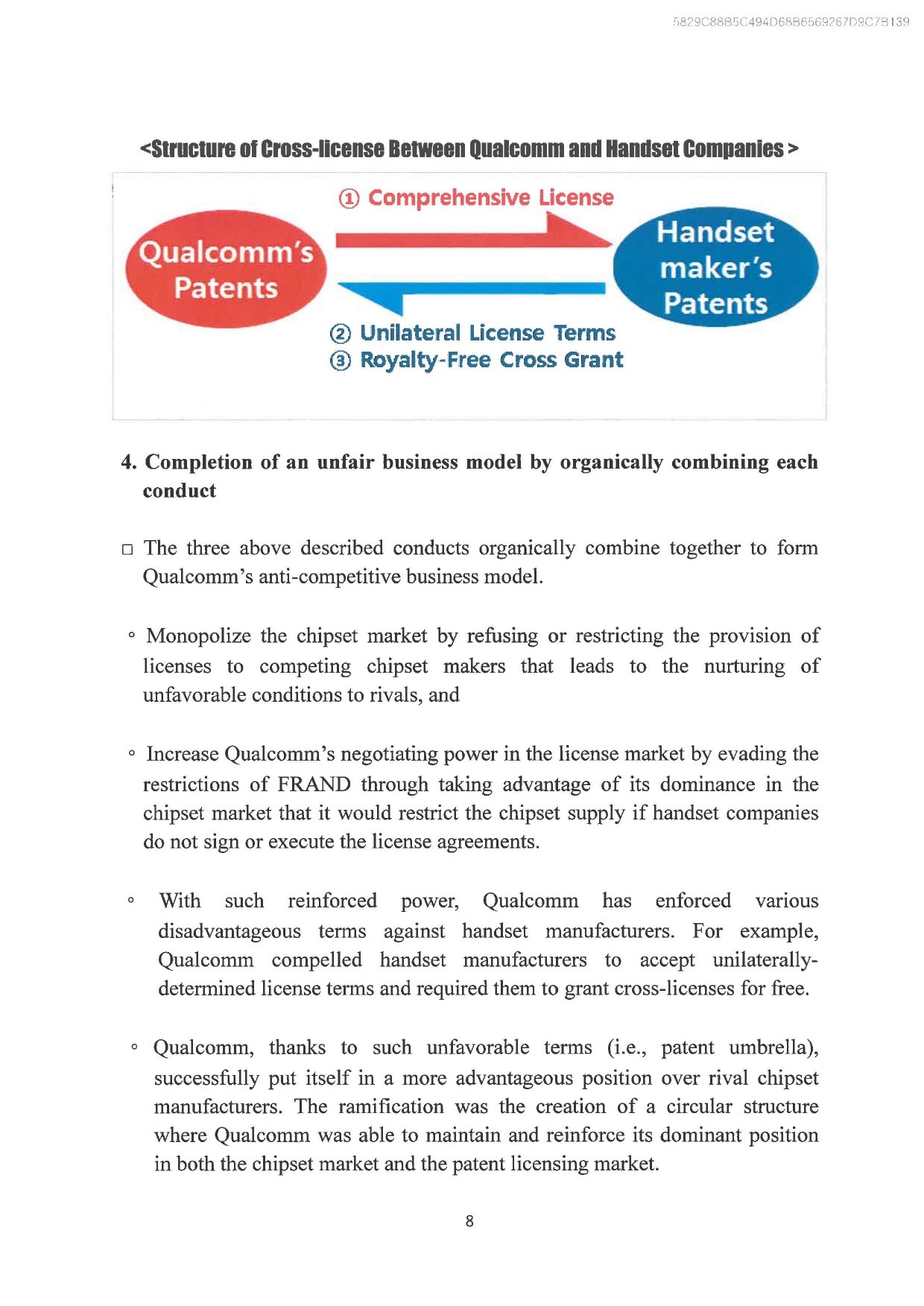

□ (Overview of Qualcomm's Business Model) As a monopolistic enterprise in mobile communications SEP market and modem chipset market, Qualcomm has established a business model that skips the chipset level and licenses at the handset level.

○ To do so, Qualcomm has CD refused or restricted to license SEPs to rival chipset makers; (2) by linking chipset supply with patent license agreements, coerced the signing and executing of unfair license agreements by using its chipset supply as leverage and circumventing FRAND commitment; then ® forced unilaterally-decided licensing terms without a fair compensation calculating process while only providing portfolio licenses, and demanded the handset makers to cross-license their patents for free.